Ada berani?

Malaysia Should Sue Goldman Sachs And All Complicit Banks!

The news today that Goldman Sachs has now formally acknowledged that its South East Asia Chairman, Tim Leissner, has indeed ‘left the bank’, sometime earlier this month, indicates they plan to make him their high level fall guy over the 1MDB imbroglio.

It’s not good enough.

Malaysia should make sure that this controversial and domineering international bank does not get away with making this single employee their scapegoat or cutting a behind-closed-doors deal with regulators over its role in a theft that goes to the heart of existing problems in our global financial systems, thanks to the illegal behaviour of banks.

If the various banks had abided by the law then 1MDB’s public money could not have gone missing — therefore the Malaysian public have a right to demand their money back and for punishments to be meted out.

After all, bank robbers go to jail, so why do robber bankers never feel the cuffs?

Any half-decent Finance Minister would have already set the ball rolling in this respect, but of course, this is one of those cases where banks thought they were protected by the political authority of their client, who was the Finance Minister.

In fact, money laundering regulations state the opposite position, which is that banks are required to exhibit extra-due diligence when dealing with politically exposed individuals, for the very reason they may potentially abuse their powers.

Exposes by Sarawak Report and others have shown that Goldman Sachs, RBS Coutts, BSI Bank, Edmund de Rothschild Bank Privee, JP Morgan Suisse, Falcon Bank and of course the ANZ majority owned AmBank all have serious questions to answer with respect to the loss of funds from 1MDB.

It’s taken years to flush out the truth, whilst all these institutions looked the other way and kept the cash — now they should pay the penalty.

Goldman Sachs knew

It is simply is not acceptable for Goldman Sachs to attempt to let

the buck stop with their now former employee, the bogus Dr Tim

that all was not well with the way Goldman had appeared to

handle the 1MDB

power purchase and Aabar bond issues, there was deafening

silence:

In fact, there was some fall-out. A few months later one of the

financial commentators, who had also been raising veiled

questions about GSI’s lucrative bond deals noted the odd

departure of Roger Ng from the bank, amidst the growing

political row in Malaysia about 1MDB.

Ng was Tim’s close subordinate. He had previously worked

for Deutsche Bank, whose close associations with corrupted

Sarawak leader Taib Mahmud had also been questioned by

NGOs and this blog, but were until recently aggressively

ignored by the German financial giant.

Ng through Deutsche Bank had raised bond deals for Sarawak

via Labuan at enormous rates of interest. Deutsche Bank also

held Taib family off-shore accounts and ran a 50% partnership

with Taib’s family company, CMS, in the major investment

outfit Kenanga (Deutsche Bank is now belatedly attempting

to sell its holding).

When Leissner hired Ng into Goldman he therefore bought

his way into Ng’s Sarawak contacts and then up into deals with

Jho Low and Najib. Together they set up the Terengganu

Sovereign Wealth Fund, which morphed into 1MDB and the

rest is a history of exceedingly lucrative deals for Goldman.

It seems that a

decision was made

to let Ng take the rap

when the noise grew

louder in 2014. But, what did Goldman Sachs decide to do about

Leissner?

Well, despite the by then prominent coverage of the concerns

over 1MDB and its huge sums of missing money, the hierarchy

of that bank went ahead and promoted him to Chairman of

South East Asia around the very same time in mid-2014.

How could Goldman Sachs have possibly promoted this man

without checking out the controversy around the deals that

had made Leissner one of the highest earners for the bank in

the period 2010–2013?

It seems they even over-looked his false academic credentials

in their eagerness to keep the hundreds of millions he had

earned for the bank. It is clear that Leissner’s superiors at

Goldman Sachs have had every opportunity for years to

investigate and act upon these deals and instead they sat

silent and promoted the man behind them.

One of these superiors, Andrea Vella knows all about being

pursued over controversial government deals. He is currently

embroiled in a case against the Libyan Investment Authority.

Now that GSI are plainly in discussions with investigators they

will be in a position to inform exactly how the massive US$3

billion that was raised for 1MDB in just one hurried week by

the bank just days before Najib Razak announced the 2013

election was disbursed.

Did it go into legitimate 1MDB accounts or was much of the

money siphoned off into thinly disguised bogus accounts, as

earlier was the case with Good Star and the money supposedly

invested in PetroSaudi?

Malaysians will be particularly interested to know if any of the

GSI bond issue money was tranfered to Aabar owned Falcon

Bank for example or to any Aabar or Jho Low related

accounts off-shore?

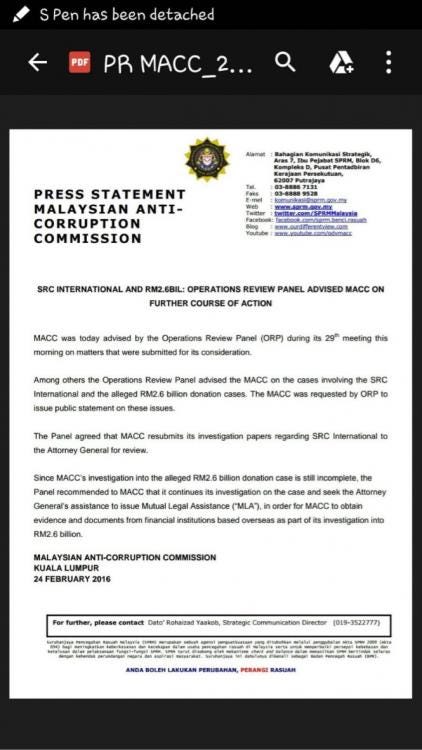

Today the MACC Operations Reveiw Panel backed the

anti-corruption commission’s request to be allowed to

continue its investigations into just these issues and to

pressure the Malaysian Attorney General into doing his

lawful job, which is to grant them their necessary authorities

to request international assistance in their enquiry into

these matters.

That international assistance would provide just the information

that the authorities which might end up suing miscreant banks

are looking for. Najib is blocking it.

For years Goldman Sachs knew there were issues about their

employee and the 1MDB deals. But, instead of doing the right

thing about potential wrong doings they promoted their

‘rainmaker’ and looked the other way.

Other banks who should be equally on notice are ANZ bank,

who have supplied all the major executives for their majority

shareholding in AmBank and failed to report or doing

anything about the humungous sums pouring into the

Prime Minister’s secret accounts.

This bank is still refusing to comment on the matter or take

any apparent action and they are refusing to inform

shareholders why they received a recent major fine from

the Bank of Malaysia for evident transgressions. Don’t

shareholders have a right to know when their bank has

been caught and fined for failures of this nature?

A swathe of banks world-wide have stood by for years

and gone for cover-up rather than owning-up. Malaysia

should teach them a lesson and find themselves a new

Finance Minister who sues the shirts off their backs and

teaches them a lesson they need to learn.

Originally published at www.sarawakreport.org.

Kenapa cina sekor kat atas tu tak sekali

pun di heret oleh pihak berwajib dalam

isu besar ni?

Apa lebihnya si kolop ni?

Lu Fikir La Sendiri!!!

Tiada ulasan:

Catat Ulasan